As a middle-aged guy, I’m a sucker for the real estate section in The Wall Street Journal.

They had a story this past week about the sale of Paul Newman and Joanne Woodward’s Central Park apartment in Manhattan. Nice view if you can get it:

The place was listed for just shy of $10 million but sold for 40% over asking at $14 million.

This part of the story caught my finance eye:

“If you were fine with having a fantastic one bedroom, you were never going to find a better one than this,” he said. “What was crazy to us was how deep that market was.”

The irony, he said, was that the week the showings took place, the weather in New York was terrible. “It was raining every single day, just like monsoons,” he said. “It was the worst time to ever launch something like this. It just shows that none of it matters.”

Here’s a realtor who sells houses to uber-rich people in Manhattan and even he was surprised by how many uber-rich people there were lining up to buy this apartment.

This is an extreme example but everyone has an economic anecdote these days about spending or costs being out of control.

They paid how much for that house?!

$25 for beers at that concert?!

Did you see their Instagram? They went on vacation to the Amalfi Coast…again?

It now costs how much for a new car?!

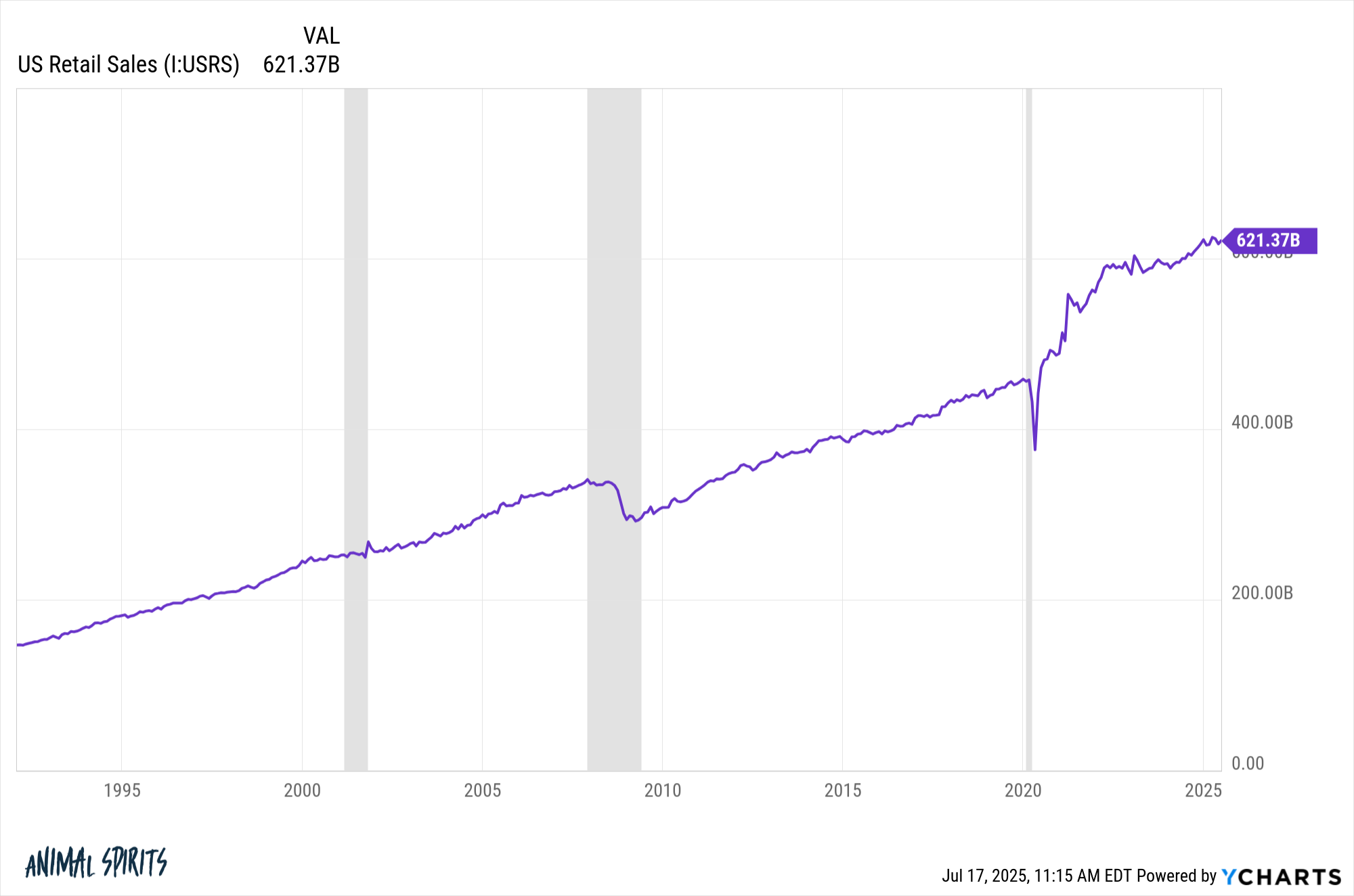

The cost of everything keeps going up yet consumers keep consuming:

We keep hearing stories about how stressed people are about money but it doesn’t seem to matter. Americans just keep spending despite everything.

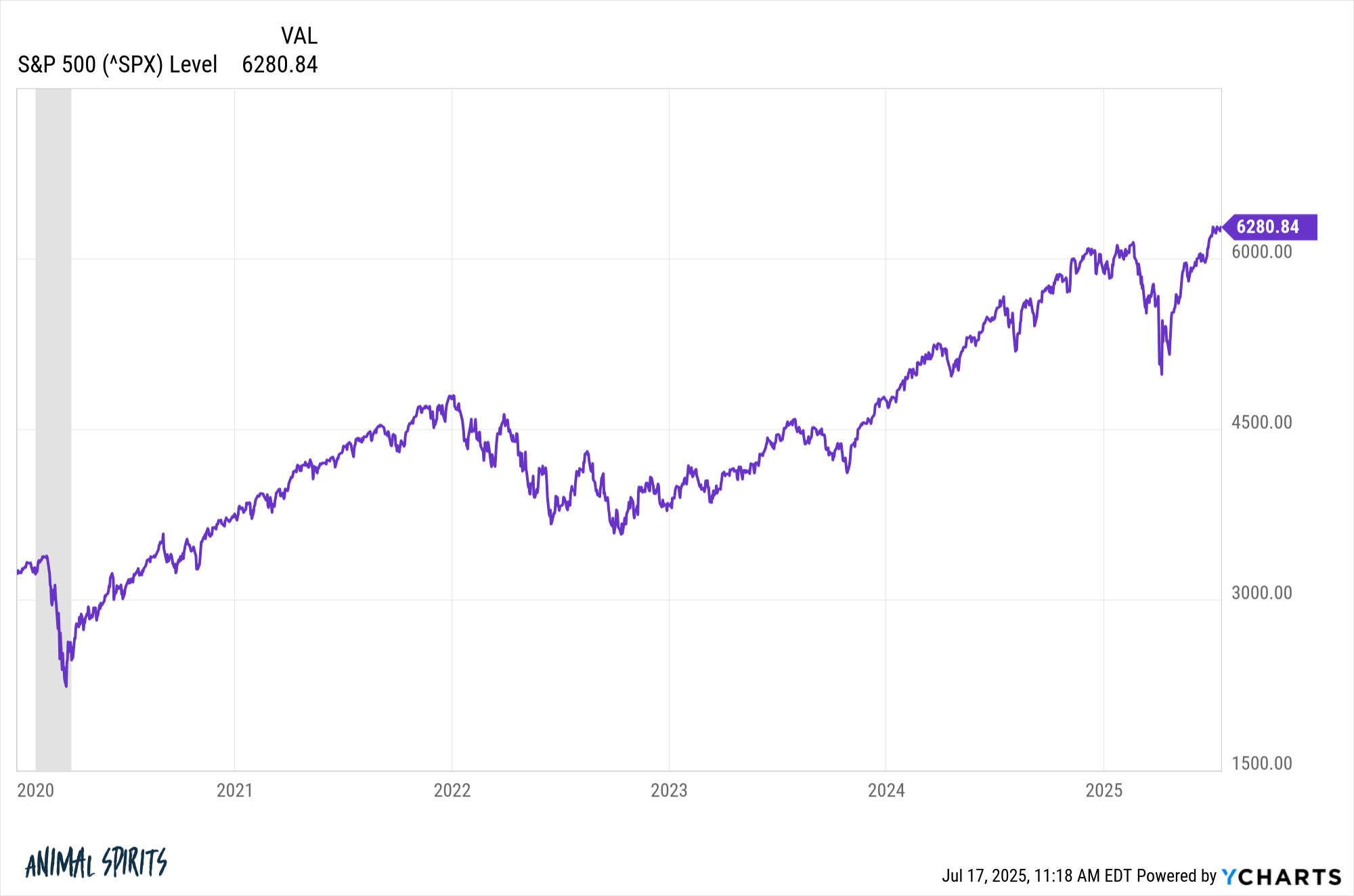

The stock market is just as resilient as the consumer:

There have been plenty of downturns this decade, but the market just keeps coming back with a vengeance.

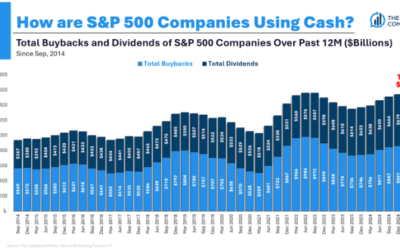

The number of insanely big corporations continues to grow as well.

Nvidia recently hit a $4 trillion market cap. There are 8 other companies in the United States with a trillion dollar valuation: Microsoft ($3.8 trillion), Apple ($3.1 trillion), Amazon ($2.4 trillion), Google ($2.2 trillion), Facebook ($1.8 trillion), Broadcom ($1.4 trillion), Tesla ($1.0 trillion) and Berkshire Hathaway ($1.0 trillion).

The big ones keep getting bigger.

Government debt isn’t slowing down anytime soon either:

For my entire adult life I’ve been told taxes have nowhere to go but up because of all the government spending and deficits. Yet tax rates just keep going down and we just passed another huge tax cut.

So the big question is: What stops this train?

What causes rich people to rein in their spending?

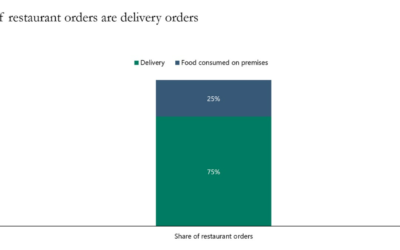

What causes consumers to stop traveling, eating out and paying for Doordash?

What causes the stock market to experience a correction that lasts longer than a movie preview?

What causes investors to pull back on speculative behavior?

What causes the U.S. government to slow its spending?

What causes the U.S. to experience its first true recession in more than 15 years?

This is going to sound like a cop-out Grand Rapids hedge answer but I honestly don’t know. It could be a Black Swan event no one sees coming. It could be an AI bubble that pops. Maybe it’s a policy mistake by the Fed or the White House.

The most likely answer is human nature will get us at some point.

Excesses will build as households and businesses become more and more comfortable making risky bets. Leverage will increase. People will become complacent. Too much stability will lead to instability.

Good luck guessing when that will happen.

I vividly remember the market finally reaching new all-time highs in 2013 for the first time since the Great Financial Crisis. A certain pundit was pounding the table that This market REEKS of euphoria!

Ah well.

The only thing I do know is that cycles don’t last forever. They always feel like they will keep going while you’re in them but they never do.

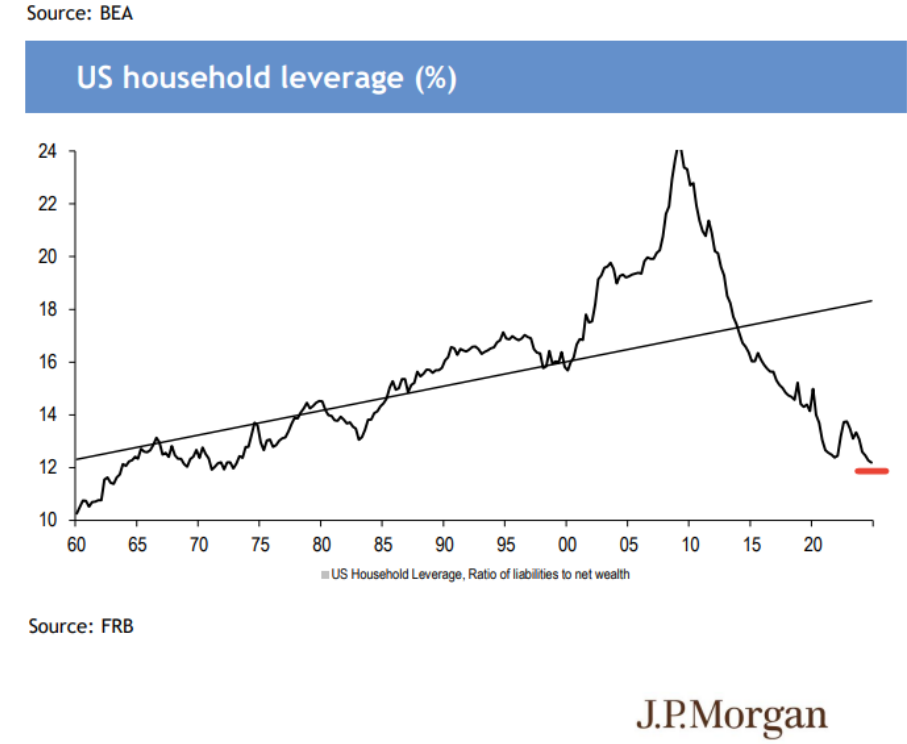

The strange thing is household balance sheets are in such good shape that when a real downturn finally happens there is plenty of dry powder available to lever up:

Sorry, even when considering the potential risks that exist I have to look on the bright side of things.

Michael and I talked about an excessive amount of rich people, what stops this train and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

I Don’t Feel Rich

Now here’s what I’ve been reading this week:

Books:

0 Comments