Use our free student loan calculator to estimate your monthly student loan payment under the various student loan repayment plans: Standard, Graduated, Extended, IBR, PAYE, SAVE, and ICR. Check out this calculator for the proposed Repayment Assistance Plan (RAP). Note the SAVE plan will likely be ending in the next 6-12 months.

To use the student loan calculator, you do need to have some basics of your loan or loans – including the interest rate and payment amounts. Take the total of all your loans and the average interest rate. Or you can tackle each loan individually. After that, the student loan calculator does the rest!

Student Loan Repayment Calculator

1

2

3

4

5

6

7

8

Mainland US

Alaska

Hawaii

Undergraduate

Graduate

function formatCurrency(value) {

return new Intl.NumberFormat('en-US', { style: 'currency', currency: 'USD', minimumFractionDigits: 0, maximumFractionDigits: 0 }).format(value);

}

function calculateRepaymentPlans() {

var balance = parseFloat(document.getElementById('loanBalance').value);

var rate = parseFloat(document.getElementById('loanRate').value) / 100 / 12;

var income = parseFloat(document.getElementById('income').value);

var familySize = parseInt(document.getElementById('familySize').value);

var location = document.getElementById('location').value;

var loanType = document.getElementById('loanType').value;

var povertyGuidelines = {

"us": [15060, 20440, 25820, 31200, 36580, 41960, 47340, 52720],

"alaska": [18810, 25540, 32270, 39000, 45730, 52460, 59190, 65920],

"hawaii": [17310, 23500, 29690, 35880, 42070, 48260, 54450, 60640]

};

var fpg = povertyGuidelines[location][familySize - 1];

var discretionaryIncomeOldIBR = Math.max(income - (fpg * 1.5), 0);

var discretionaryIncomeNewIBR = Math.max(income - (fpg * 1.5), 0);

var discretionaryIncomePAYE = Math.max(income - (fpg * 1.5), 0);

var discretionaryIncomeSAVE = Math.max(income - (fpg * 2.25), 0);

var discretionaryIncomeICR = Math.max(income - fpg, 0);

var resultText="

| Repayment Plan' + ' | Monthly Payment' + ' | Total Interest Paid' + ' | Total Amount Paid' + ' | Total Forgiveness';

if (balance && rate && income && familySize) { |

|---|---|---|---|---|

| Standard' + ' | ' + formatCurrency(standardPayment) + '' + ' | ' + formatCurrency(totalInterestStandard) + '' + ' | ' + formatCurrency(totalPaidStandard) + '' + ' | $0';

// Graduated Repayment Plan for (var i = 0; i < graduatedMonths; i++) { |

| Graduated' + ' | ' + formatCurrency(minPayment) + ' - ' + formatCurrency(maxPayment) + '' + ' | ' + formatCurrency(Math.round(totalInterestGraduated)) + '' + ' | ' + formatCurrency(totalPaidGraduated) + '' + ' | $0';

// Extended Repayment Plan |

| Extended' + ' | ' + formatCurrency(extendedPayment) + '' + ' | ' + formatCurrency(totalInterestExtended) + '' + ' | ' + formatCurrency(totalPaidExtended) + '' + ' | $0'; } else { resultText += ' |

| Extended: Does Not Qualify (Balance must be over $30,000)'; } // Income-Based Repayment (Old) for (var j = 0; j = interestIBROld) { | ||||

| IBR (Old)' + ' | ' + formatCurrency(ibrOldPayment) + '' + ' | ' + formatCurrency(Math.round(totalInterestIBROld)) + '' + ' | ' + formatCurrency(totalPaidIBROld) + '' + ' | ' + formatCurrency(Math.round(totalForgivenessIBROld)) + '';

// Income-Based Repayment (New) for (var k = 0; k = interestIBRNew) { |

| IBR (New)' + ' | ' + formatCurrency(ibrNewPayment) + '' + ' | ' + formatCurrency(Math.round(totalInterestIBRNew)) + '' + ' | ' + formatCurrency(totalPaidIBRNew) + '' + ' | ' + formatCurrency(Math.round(totalForgivenessIBRNew)) + '';

// PAYE for (var l = 0; l = interestPAYE) { |

| PAYE' + ' | ' + formatCurrency(payePayment) + '' + ' | ' + formatCurrency(Math.round(totalInterestPAYE)) + '' + ' | ' + formatCurrency(totalPaidPAYE) + '' + ' | ' + formatCurrency(Math.round(totalForgivenessPAYE)) + '';

// SAVE 2024 for (var m = 0; m = interestSAVE) { |

| SAVE 2024' + ' | ' + formatCurrency(savePayment) + '' + ' | ' + formatCurrency(Math.round(totalInterestSAVE)) + '' + ' | ' + formatCurrency(totalPaidSAVE) + '' + ' | ' + formatCurrency(Math.round(totalForgivenessSAVE)) + '';

// ICR for (var n = 0; n = interestICR) { |

| ICR' + ' | ' + formatCurrency(icrPayment) + '' + ' | ' + formatCurrency(Math.round(totalInterestICR)) + '' + ' | ' + formatCurrency(totalPaidICR) + '' + ' | ' + formatCurrency(Math.round(totalForgivenessICR)) + ''; } else { resultText += ' |

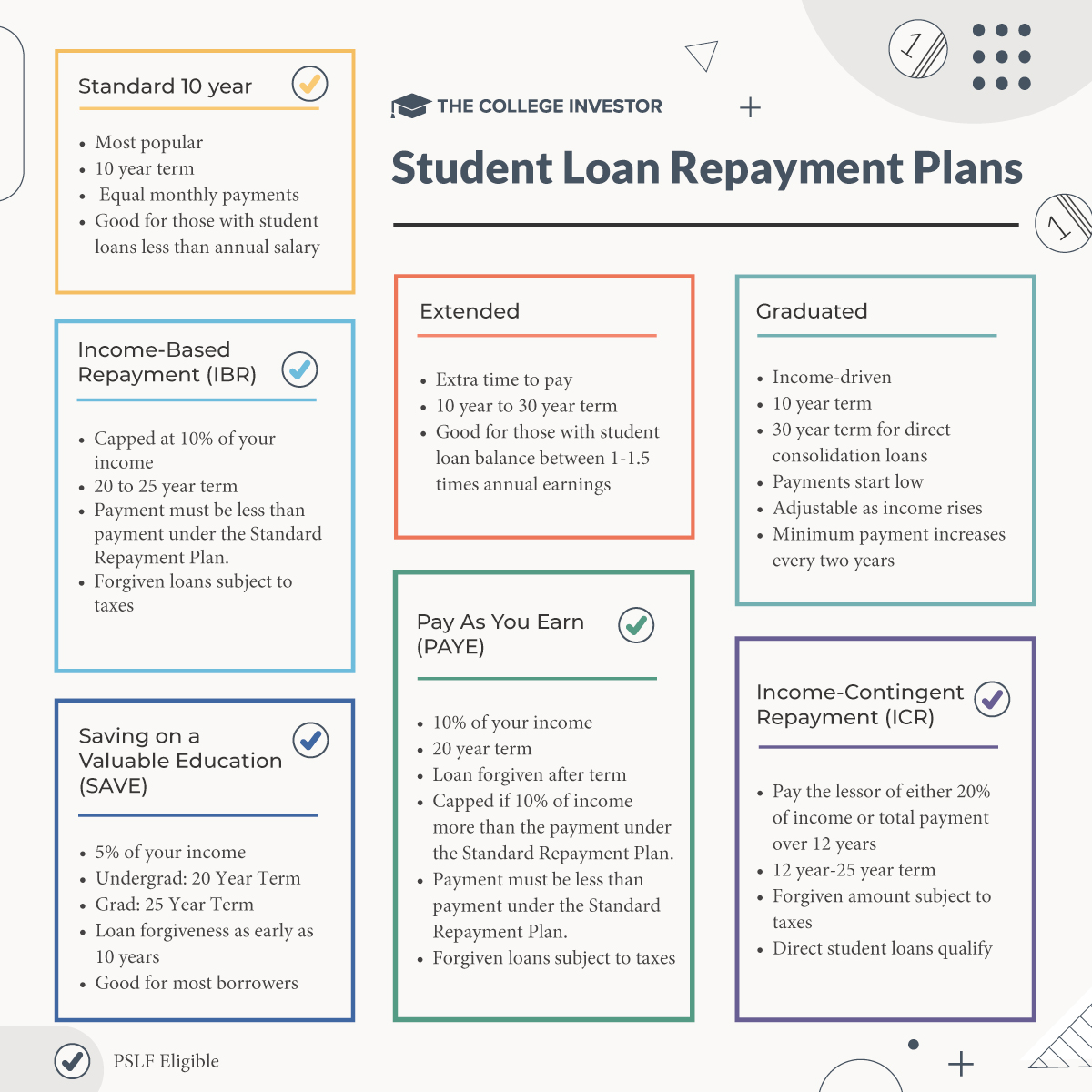

| Please fill in all required fields.'; } resultText += ''; document.querySelector('button').addEventListener('mouseover', function() { document.querySelector('button').addEventListener('mouseout', function() { * This calculator has been updated to reflect the latest SAVE repayment plan calculations. What You Need To Know For Our Student Loan CalculatorWhen you are planning the details of your student loan repayment, there are definitely a few things you need to know. Loan AmountsYou need to know your student loan balance to accurately use the calculator. For this calculator, you should either: combine all your loans into one amount, or calculate each loan individually. We recommend you calculate each loan individually, which can then help you setup the best debt payoff method – either the debt snowball or debt avalanche. Loan TermBeyond the loan amount, how much time is left on your loans plays a huge part in your monthly payment amount. The standard repayment plan for Federal loans is 10 years. However, if you opt into another student loan repayment plan, your loan term may be longer (up to 25 years). On the flip side, if you’ve been paying your student loans for several years, your loan term may be shorter. This calculator assumes the full loan term, so if you’ve already been in repayment for a bit your numbers on the Standard Plan, Extended Plan, and Graduated Plan may vary. Interest RateA lot of people are concerned about their student loan interest rate – and it does play a big factor (especially for private student loans). However, for Federal loans, it plays a much smaller factor. In fact, recent loans may have a rate as low as 2%, while those a few years old may still see rates around 6%. Old loans could see rates pushing 8-10%. Those loans may be better being refinanced, unless you’re seeking student loan forgiveness. Related: How Much Does Your Student Loan Interest Rate Really Matter? Repayment Plan OptionsThe output of the calculator will show you the various monthly payments under different repayment plans. Here’s what those plans are: Standard 10-Year, Graduated, Extended, IBR, PAYE, SAVE, and ICR. Important Note About SAVE: SAVE is currently blocked by the courts. Borrowers enrolled in the SAVE plan are currently in Administrative Forbearance. However, we anticipate that SAVE will be allowed to continue, at least for the monthly payment aspect. Does Student Loan Refinancing Make Sense?Student loan refinancing can make sense for some borrowers, especially those with private student loans. If you have Federal student loans, refinancing typically only makes sense if you are NOT going for any type of loan forgiveness, and plan to pay off your loan within 5 years. Remember, you’re going to get the best rate on a short-term (5 years or less) variable student loan. The longer the loan, the higher the rate typically will be. It may not even be much better than your current loans. You can shop student loan refinancing options here. Additional Factors To ConsiderThe important thing to remember with student loans (especially Federal loans), is that payment isn’t the only factor to consider. Federal loans specifically have a lot assistance options that can be very beneficial. For example, student loan forgiveness options, hardship deferment options, and income-driven repayment plans. These benefits are likely worth more than a little extra interest. However, for private student loans, you typically don’t have any of these options available, in which case student loan interest rate and term length are the biggest factors. Finally, if you are considering refinancing your student loans, credit score and debt-to-income ratio play a big factor in getting the best rate. Make sure you know your credit score before applying so you know what to expect. More Stories: How 16 Real People Paid Off Their Student Loan DebtHow 16 Real People Paid Off Their Student Loan Debt

Debt Snowball vs. Debt Avalanche: Which Debt Payoff Method Is Best?Debt Snowball vs. Debt Avalanche: Which Debt Payoff Method Is Best?

Budgeting Strategies: 50/30/20 vs. Zero-Based vs. Pay Yourself FirstBudgeting Strategies: 50/30/20 vs. Zero-Based vs. Pay Yourself First

Editor: Clint Proctor Reviewed by: Chris Muller The post Student Loan Calculator appeared first on The College Investor. Related PostsYou Should Love The 529 Plan More After OBBBA PassedAs soon as both my children were born in 2017 and 2019, I superfunded their 529 plans equal to the five-year gift tax exemption. At the time, I was thrilled to do it given a parent's number one responsibility is to provide for their children. Finally, a tax-efficient... How To Track And Organize Scholarship ApplicationsKey PointsHigh school seniors often apply to dozens of scholarships, each with unique deadlines and requirements, making organization a challenge.A spreadsheet, calendar, or other system can help families manage tasks, track status, and avoid missed... Best MBA Student Loans To Pay For Business SchoolThe best MBA student loans are federal loans, followed by private. But student loans aren't the only way (or best way) to pay for business school.The truth is: getting an MBA is expensive. The Masters of Business Administration degree could be a way to bolster your... 0 Comments | ||||

0 Comments