A reader asks:

I recently sold my condo for $400k and want to invest the money in the stock market. However, it appears the market is at an all time high. Should I invest elsewhere or wait for a market correction?

Excellent question.

Let’s start with the math first and then work our way to the psychological ramifications.

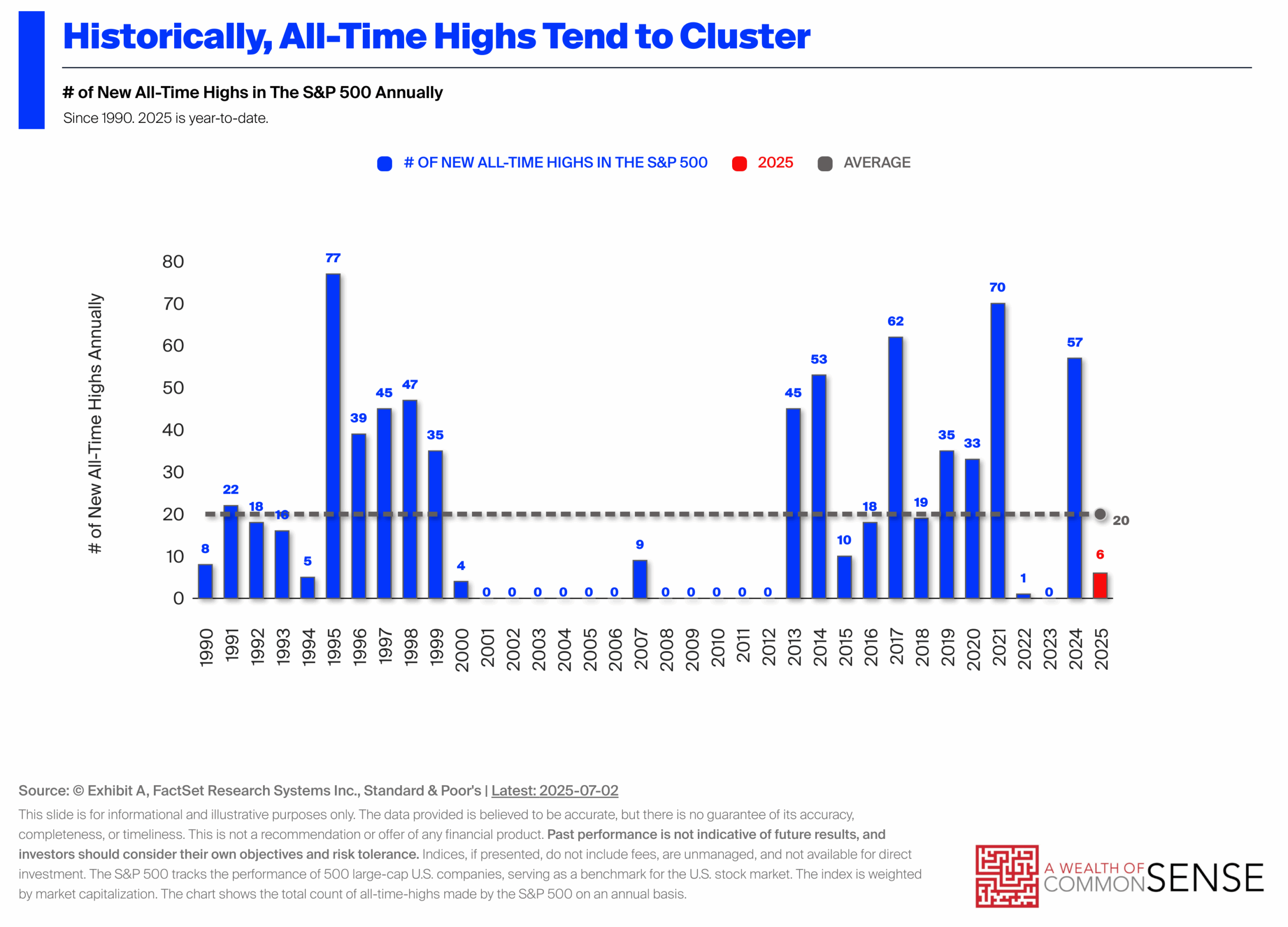

Here are some charts from Exhibit A on the history of all-time highs:

The good news is that new all-time highs are perfectly normal. On average they happen 20 times a year since 1990.

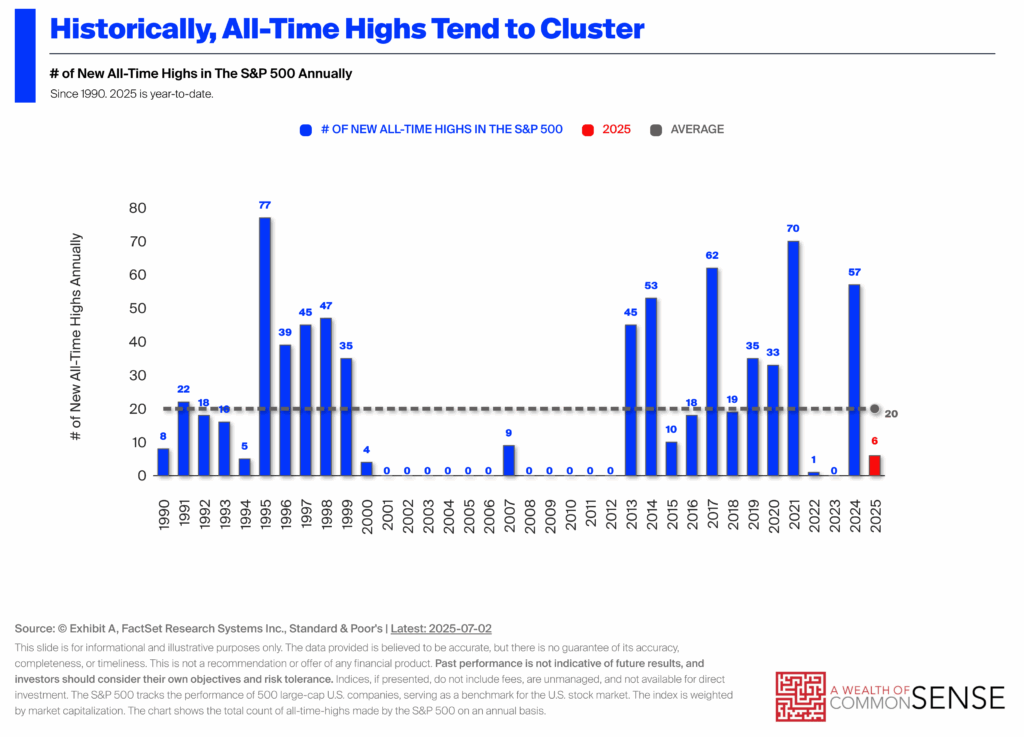

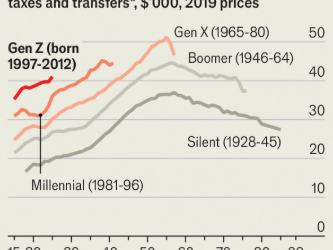

The bad news is that there can be dry spells as those new highs tend to cluster. Here’s another way of looking at this:

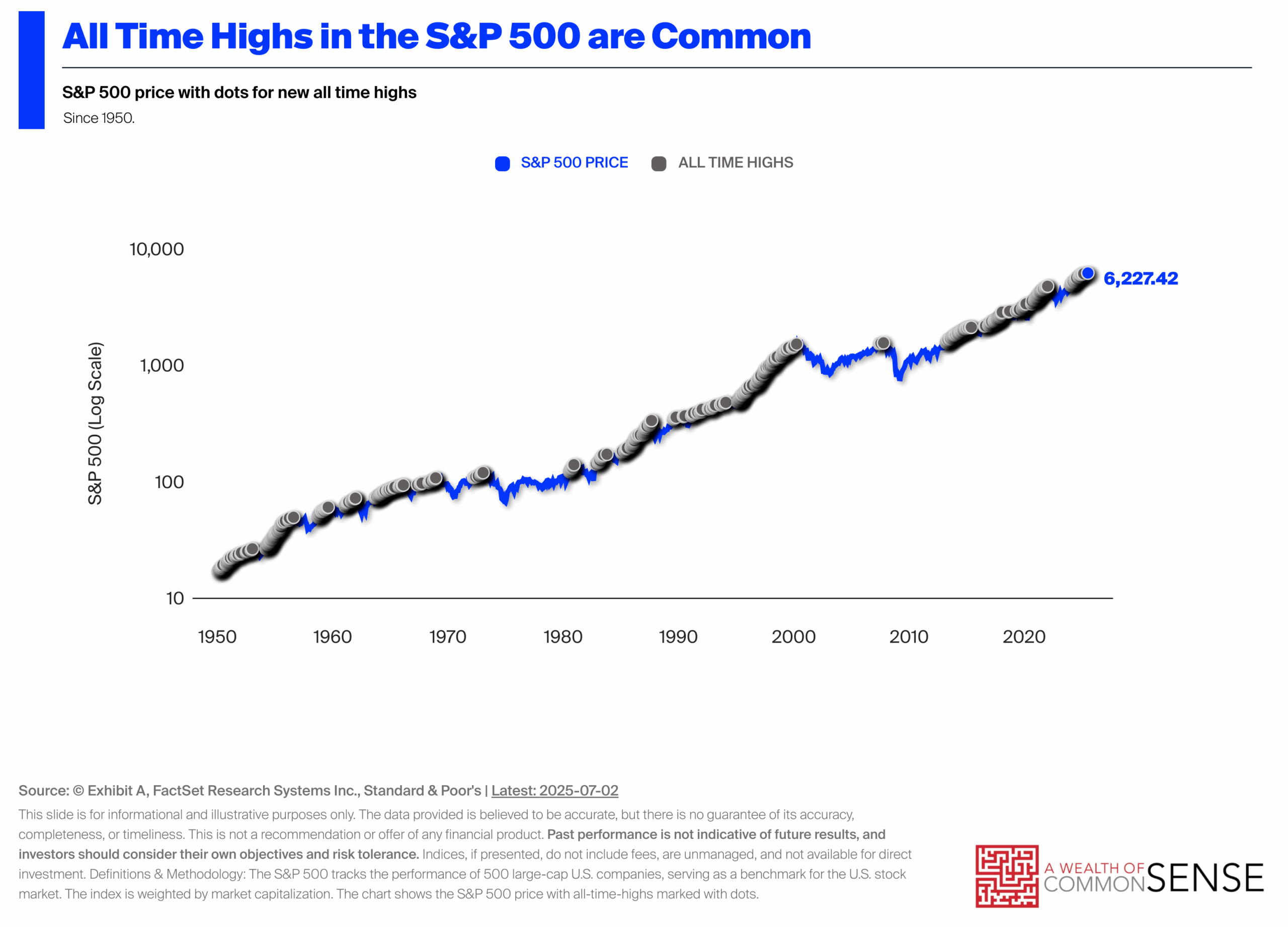

Obviously, the all-time highs cluster around bull markets while the droughts are caused by bear markets and lost decades.

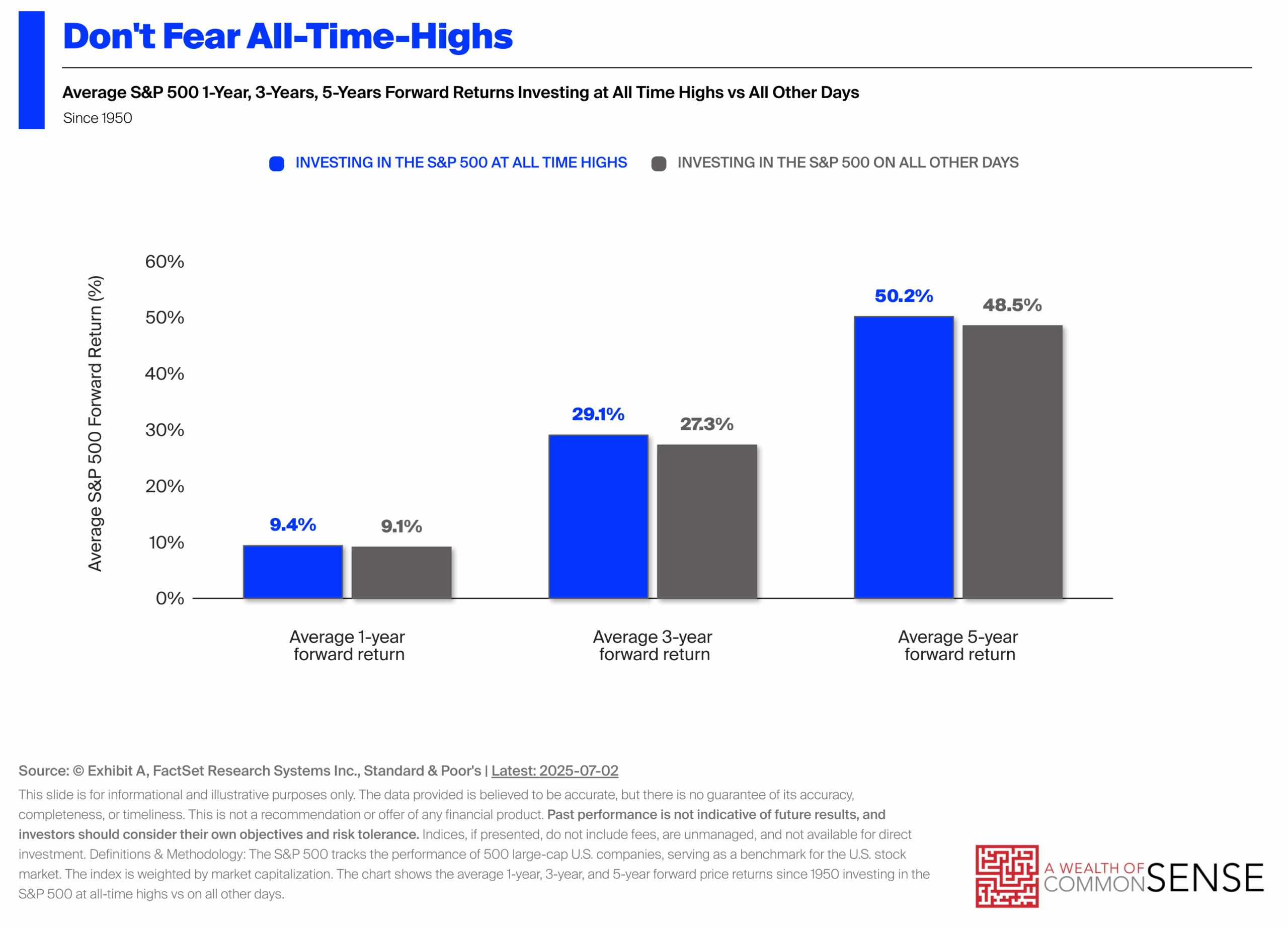

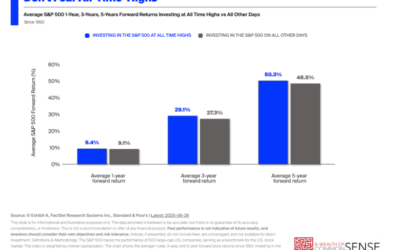

Let’s do some more good news since I like to be positive:

Not only are new all-time highs perfectly normal, your returns are actually better when you invest at those levels than putting your money to work on all other days over 1, 3 and 5 year windows.

If you’re looking at this strictly from a cost-benefit perspective, you don’t need to be scared off by new highs in the stock market. They happen more often than you think.

Long-term investors need to become accustomed to buying and holding at new heights.

People have been trying to call THE top of this bull market since the bottom in 2009.

The thing is one of these all-time highs will be THE peak that occurs before a nasty market crash. There will be a painful bear market and we won’t see new highs for a few years.1

This is the hard part when thinking through a lump sum investment like this.

The math tells you the stock market is up three out of every four years, on average, and investing at all-time highs offers slightly above average results. Those are pretty good odds.

But the psychology tells you losses bring far more pain than the pleasure you receive from gains.

This is why many people are more comfortable dollar cost averaging into the market, even if it’s a sub-optimal approach from a spreadsheet perspective.

Regret minimization is key when working through these decisions.

Some people would regret missing out on further gains if they dollar cost averaged into stocks and the market keeps moving higher. Most people would feel more regret if they put that lump sum to work and the market immediately rolled over.

You shouldn’t always allow behavioral psychology to guide your actions but you have to weigh the pros and cons of both the math and human nature when making big investment decisions like this.

You also don’t have to put all of this money into stocks. You could create a more balanced portfolio of stocks, bonds, cash and other investments if that makes it easier to be fully invested sooner.

An all-or-nothing approach tends to invite more opportunities for regret.

Michael and I talked about investing at all-time highs and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

The Lump Sum vs. Dollar Cost Averaging Decision

Now here’s what I’ve been reading lately:

Books:

1It’s worth noting we went two years or so with no new highs from the 2022 bear market.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.

0 Comments