A reader asks:

I’m in my last year studying financial econ and looking to get into advising or wealth management. I’m thinking of doing CFA Level 1 a month after I graduate before starting the CFP path. A lot of my fourth-year work lines up with CFA content and I’m still recovering from a neck injury from pro hockey so I can’t work yet. Figured that next year is a good time to focus on exams. Do you think CFA Level 1 is worth it for someone going into advising mainly to better understand markets and explain them to clients? CFP is the goal but I want that deeper market and econ knowledge and I have a ton of downtime in my fourth year of uni.

I know a lot of people who think these designations aren’t useful anymore.

I don’t necessarily agree.

For young people without a lot of experience or connections, they show potential employers you’re willing to put in the time and effort to improve yourself. Getting the CFA designation was helpful to my career prospects early on when most of the jobs I was applying for required it.1

Just sitting for the Level 1 exam helped get me a foot in the door for my second job out of college.

But I was looking exclusively for portfolio management roles. I was working in the institutional investment management space, not wealth management. I don’t necessarily think the CFA is the right choice early in your career if you want to become an advisor.

Even though you’re studying markets in school I would still focus on getting your CFP first. There simply aren’t going to be that many advisory firms that emphasize the depth of knowledge you get from taking the CFA exams.

The CFA is considered the gold standard for investment analysis and portfolio management but doesn’t hold a lot of sway in the wealth management industry where holistic planning is the focus. You’re better off gaining financial planning knowledge from the CFP.

Plus, the CFA exams are a lot of work. They recommend 300 hours of study per test and the average person who passes the exams usually fails at least one. That means you’re looking at a commitment of 2-3 years and over a thousand hours of study time.

It’s also never been easier to gain market knowledge on your own through blogs, newsletters, social media and podcasts. If you are inclined to follow or learn about investing, there are more avenues than ever before.

I would also spend more time honing your communication and sales skills than learning a bunch of formulas for the CFA. People skills are more important in wealth management than numbers.

Firms that hire financial advisors or customer service associates — especially in retail or high-net-worth planning — value the CFP far more highly than the CFA because it helps provide more client-facing expertise in tax, estate, retirement, and insurance planning.

Obviously, investment management plays a huge role in the financial planning process but it’s certainly not the only thing advisors help their clients with. You can always get the CFA later on if you find the right organization that has a hole in the portfolio management side of the equation. I have colleagues who have both the CFA and CFP so it’s not out of the ordinary to do both.

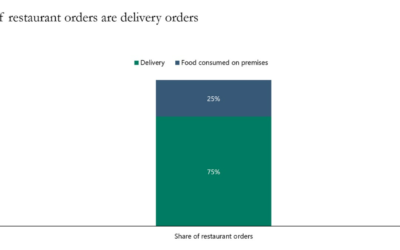

With 70+ million baby boomers retiring, 70 million millennials coming into their prime earning years and more people than ever invested in the stock market, there is going to be a bull market in financial advice in the years ahead.

That’s where my focus would be as a young person looking to get into wealth management.

I answered this question on the latest edition of Ask the Compound:

I also answered questions about the perfect level of wealth, purchasing a second home, the cost of owning a dog, failing your CFA exam, transitioning into retirement and the pros and cons of working with a realtor.

Michael and I discussed how young people can break into the wealth management industry during a live taping of Animal Spirits from the Morningstar Conference recently:

1Or at least showing some progress and passing a level or two.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.

0 Comments