Today’s Animal Spirits is brought to you by Vanguard:

This episode is sponsored by Vanguard. Learn more at: https://vgi.vg/3GbOsYM

On today’s show, we discuss:

Listen here:

Charts:

Favorites:

Tweets/Bluesky:

The dollar is off to its worst start to a year since Bretton Woods ended in 1973 pic.twitter.com/k1G2eVQEv1

— Jake (@EconomPic) June 30, 2025

Interesting split: Growth sectors are outperforming in the US, while Value sectors are leading the rest of the world pic.twitter.com/ftgZwFEe1z

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) June 25, 2025

Israel $EIS has been the best performing country ETF in our asset class matrix in the second quarter.

Up 24.7%. 🔥 pic.twitter.com/fCuvmrpIvj

— Bespoke (@bespokeinvest) June 30, 2025

“At year-end 2024, Individual Retirement Accounts (IRAs) and 401(k) plans accounted for 58% of the $44 trillion of total US retirement market assets” – GS pic.twitter.com/Tdt42U60hy

— Sam Ro 📈 (@SamRo) June 23, 2025

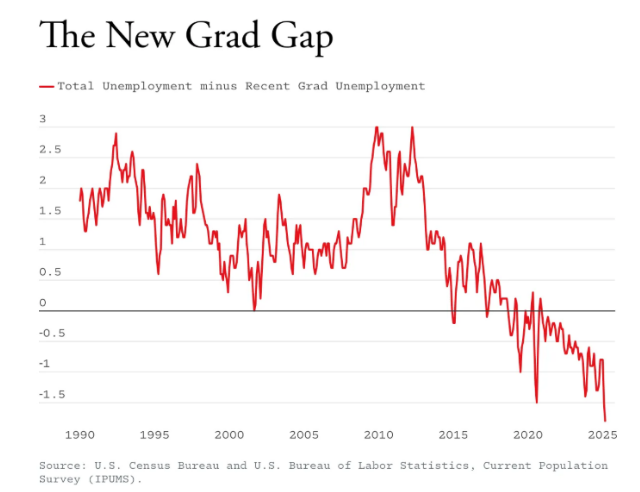

Counter #’s

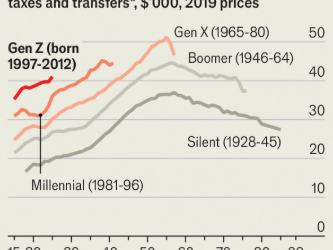

The average college graduate is now 24 years old, up from 22 in the 1980s and 40%+ of graduates now go on to graduate school, compared to roughly 20 to 25% in the 1980s.

Thus, the applicable bucket is 25-29 year olds where unemployment is near a record low. https://t.co/SQ2Wqr3MPK pic.twitter.com/fIZeqaWS3Z

— Jake (@EconomPic) June 26, 2025

loan underwriters at freddie mac determining if an unemployed teenager has enough fartcoin to secure a mortgage. pic.twitter.com/8tRin6krYU

— Dip Wheeler (@DipWheeler) June 25, 2025

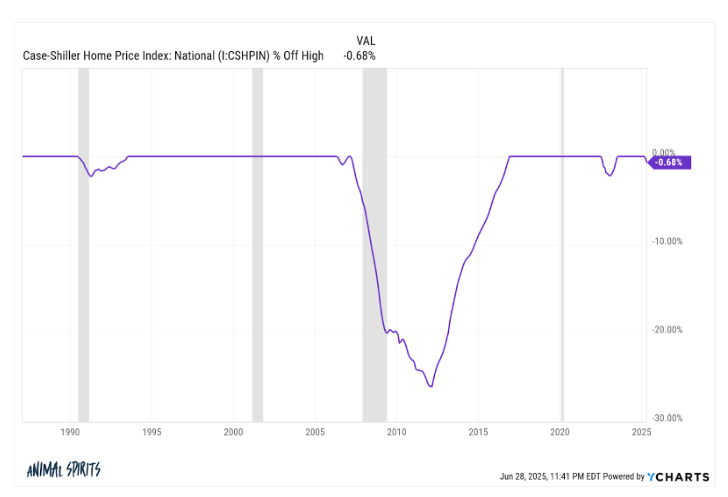

Just released Q1 2025 NMDB data reveals:

– 20.7% of mortgaged homes have a rate <3%

– 32.7% have a rate 3.0 – 3.99%

– 17.9% have a rate 4.0 – 4.99%

– 9.9% have a rate 5.0 – 5.99%

– 18.8% have a rate >= 6%81% of mortgaged homes have a rate below 6%, that’s down from the peak of… pic.twitter.com/3kCJZyL76P

— Odeta Kushi (@odetakushi) June 30, 2025

Ever wonder if you should be tipping your Uber driver after a ride?

Tipping on Uber rides is entirely optional, says CEO Dara Khosrowshahi, who addresses the growing question.

While just over 20% of riders currently tip, that number is rising. Khosrowshahi emphasizes it’s a… pic.twitter.com/AYE9YKUlu3

— CBS Sunday Morning 🌞 (@CBSSunday) June 27, 2025

‘THE SOCIAL NETWORK 2’ is officially in the works

Aaron Sorkin is returning to write, and also direct

(via: Deadline) pic.twitter.com/8ggDWoVQAi

— ScreenTime (@screentime) June 25, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.

0 Comments