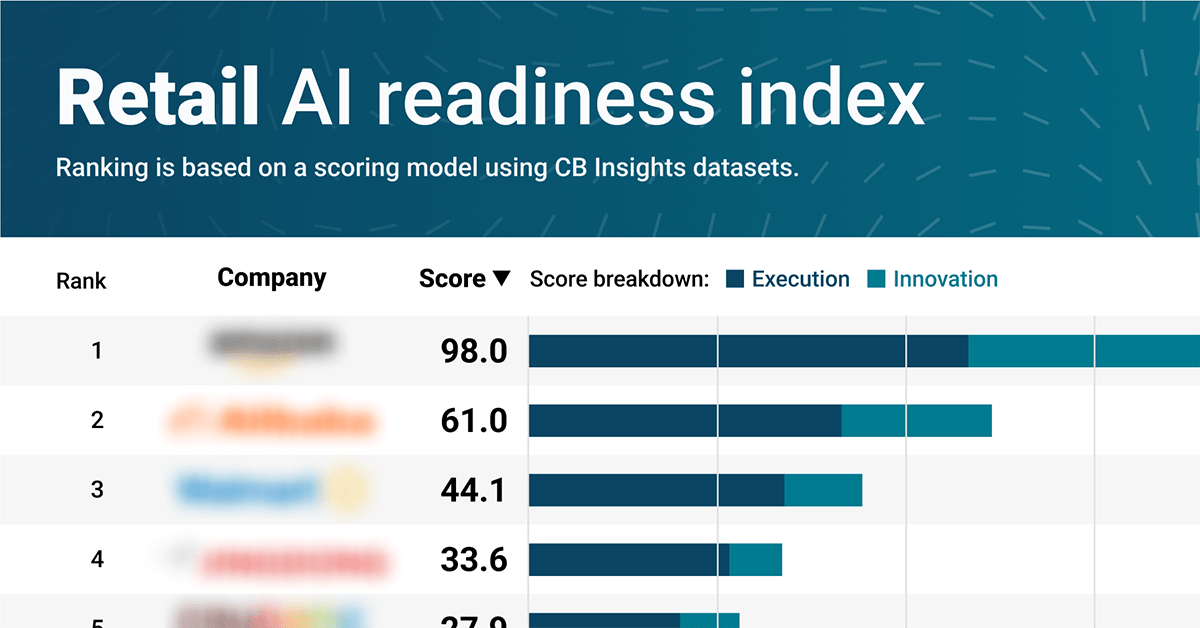

Which retailers are most prepared for AI to transform commerce? Our AI Readiness Index benchmarks the world’s largest retailers across AI execution and innovation.

The future of shopping is around the corner.

Tech giants have rocketed ahead with a parade of autonomous (and agentic, in the case of OpenAI’s Operator) shopping tools. At the same time, payment behemoths Visa, Mastercard, and PayPal are all developing solutions to enable agentic payments.

To keep up, retail leaders are building out the foundational layer for autonomous commerce, integrating AI technology into everything from search and personalization to supply chain automation.

Still, none of them have launched an autonomous shopping agent that can make purchases on behalf of a customer. But retailers are actively investing in AI with the aim of maintaining control of the customer experience, first-party customer data, and pace of innovation in the longer term.

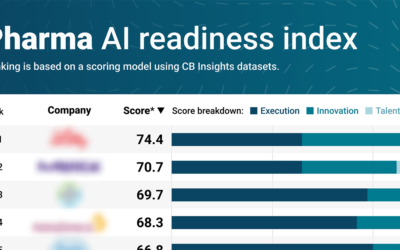

We examined the top 20 global retailers by market cap and ranked them based on their current AI capabilities to gauge their preparedness to evolve with the rapidly changing AI landscape. We used CB Insights data on investments, acquisitions, partnerships, patents, and earnings transcripts since January 2023 to determine the companies’ AI activity.

Our analysis scores the retailers in 2 key areas:

- Execution: The execution score measures a retailer’s current ability to deliver AI-powered products and services to customers and shoppers, as well as to deploy AI internally across business and back-office functions. We based this score on CB Insights data, including business relationships, product launch media mentions, and earnings transcripts.

- Innovation: The innovation score assesses a retailer’s track record of investing in, acquiring, or developing novel AI capabilities to power its future AI adoption. We based this score on CB Insights data, including patents, acquisitions, and deal-making activity.

Below are the 20 biggest global retailers by market cap, ranked by their preparation to transform their businesses and shopping with AI:

Key takeaways

- Top-ranked firms like Amazon and Alibaba are investing heavily in a core AI infrastructure that creates a scalable advantage that the rest of their business will build on. While Amazon and Alibaba have launched AI shopping solutions, both retailers’ real advantages lie deeper. They’ve built AI infrastructure from custom AI chips (Amazon) to proprietary LLMs (both retailers), which power AI development across their businesses. Amazon has positioned itself significantly ahead in future-looking innovation through investments, with a particular focus on foundational AI models and warehouse and supply chain automation.

- Partnerships with AI leaders and big tech companies will be most retailers’ ticket to AI adoption. Below the top 5 AI-ready retailers in the ranking, partnerships with big tech players and others are powering AI adoption. These relationships suggest that external partnerships and infrastructure will be essential for most retailers to effectively integrate AI throughout their operations.

- While agentic commerce remains further on the horizon, retailers are investing in AI to streamline operations, especially in merchandising. Leading retailers are deploying genAI tools for personalization and efficiency across several merchandising functions, both online and in-store, including genAI search, specialized merchant tools, inventory forecasting, and delivery route optimization. But it’s perhaps most notable that none of the retailers on the list have tackled agentic commerce. For now, retailers have placed big tech leaders, such as OpenAI and Google, in the driver’s seat to control agentic commerce infrastructure and offer retailers crucial partnership opportunities as the technology evolves.

Top-ranked firms like Amazon and Alibaba are investing heavily in a core AI infrastructure that creates a scalable advantage that the rest of their business will build on.

While both Amazon and Alibaba have launched AI shopping assistants and merchandising tools, both retailers’ real advantage is in the potential to build on their foundational AI stack.

Over the past 2 years, both companies have introduced genAI platforms through their cloud computing divisions. AWS created Amazon Bedrock in 2023, which lets businesses build genAI applications using various AI models, including Amazon’s own Nova model. Amazon also makes its own AI chips.

Meanwhile, Alibaba Cloud launched its Qwen model family in 2023, its Model Studio in 2024, and in 2025 made its AI models for video generation open source. The company also continues to expand vertical solutions, including an AI-powered weather forecasting model to enhance farm performance, as well as multiple medical diagnosis and virus detection tools.

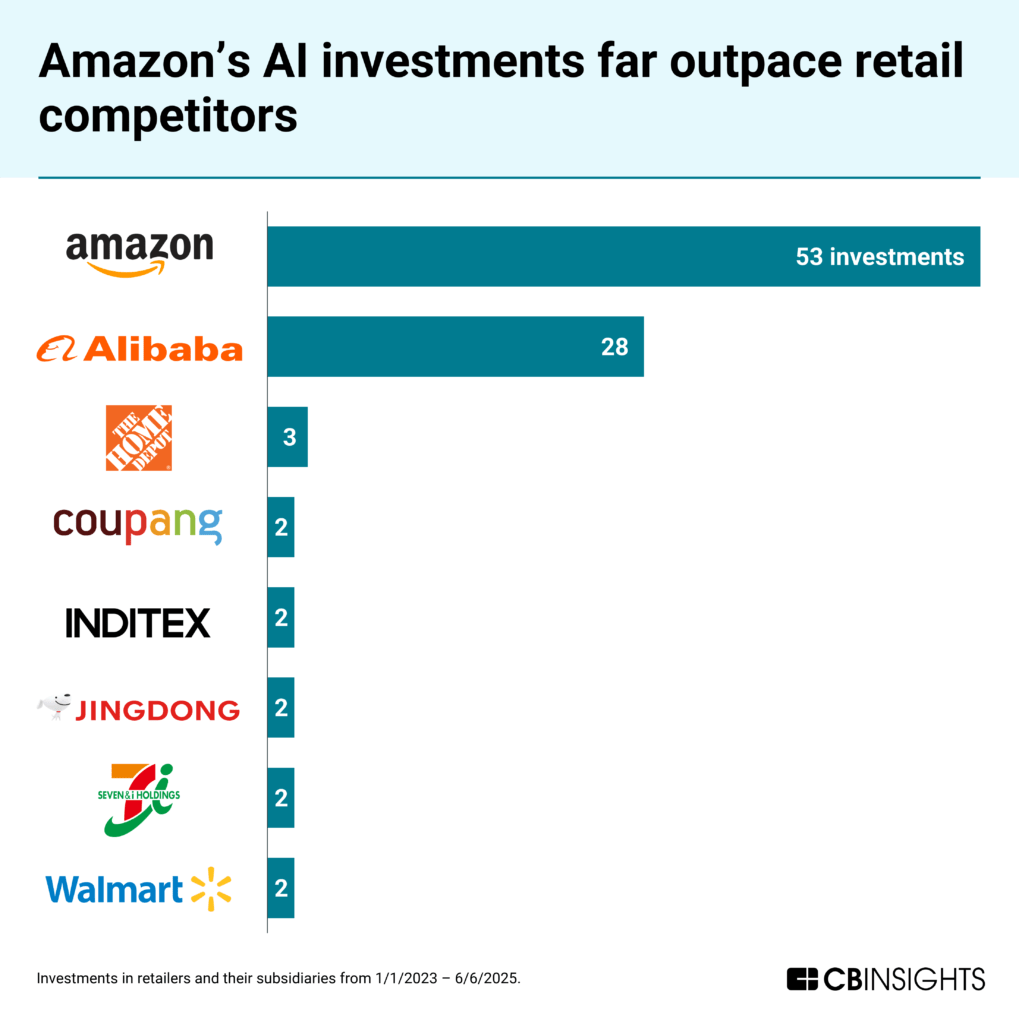

In addition to its internal development, Amazon has positioned itself significantly ahead in future innovation. Across all of its subsidiaries, the company has made 53 investments and 2 acquisitions of AI companies since 2023, nearly twice as many as Alibaba (28 investments and 0 acquisitions). The company has invested in a variety of AI models (including 3 investments in Anthropic), agents, and applications, from warehouse automation to AI for crop modification to voice AI gaming.

These foundational tools enable downstream business units — from logistics and supply chain to healthcare and agriculture — to accelerate their own AI initiatives without reinventing the wheel.

Amazon’s Bedrock and proprietary chips, for instance, give its retail and logistics operations priority access to high-performance infrastructure, accelerating their deployment of AI in warehousing and delivery.

By owning the full stack — hardware, models, platforms, and end-user applications — these companies ensure their AI gains compound across business units, from consumer interfaces to internal operations.

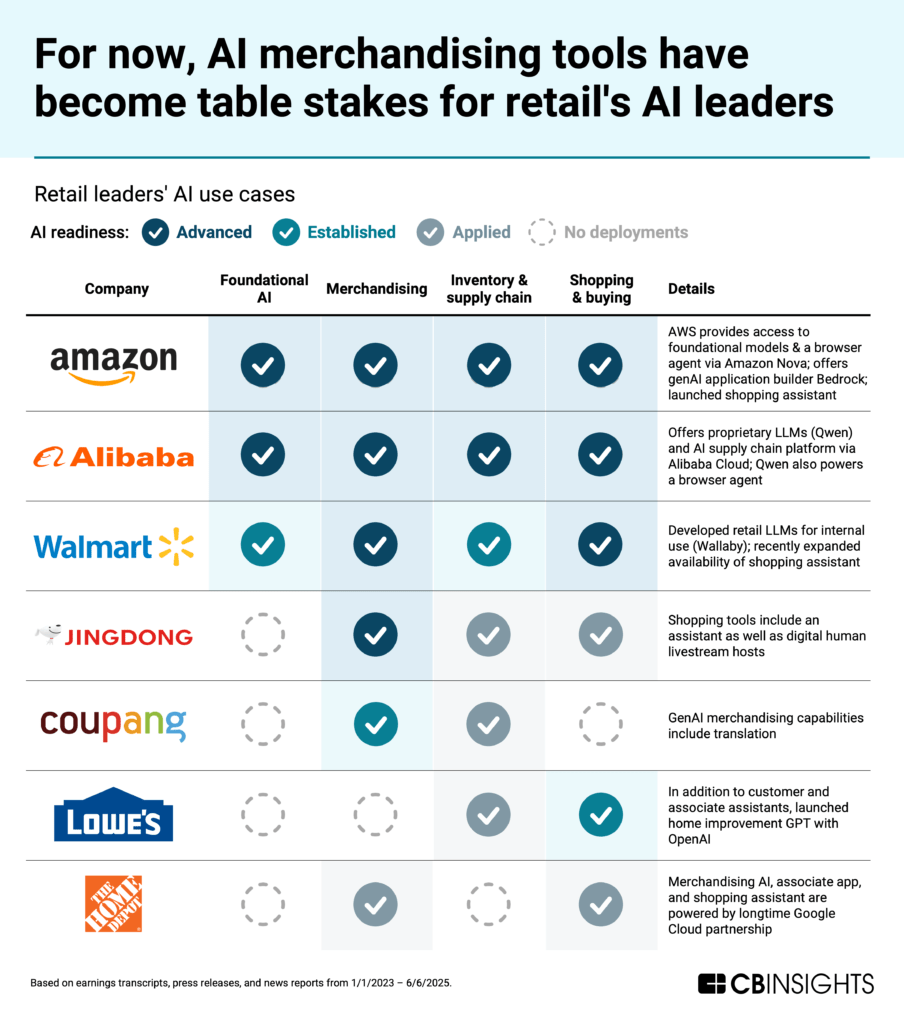

Notably, the second tier of AI-ready retailers — Walmart, JD.com, and Coupang — is also building AI toolkits through proprietary infrastructure. Walmart has developed its own retail-specific LLMs and has introduced assistants for its merchants, associates, and shoppers, as well as AI tools for virtual fitting and shelf condition tracking. JD.com and Coupang have been similarly active in internally developing merchandising tools, including digital human livestream hosts and generative AI translation.

Partnerships with AI leaders and big tech companies will be most retailers’ ticket to AI adoption.

Below the top 5 AI-ready retailers in the ranking, partnerships with big tech players and others are powering longer-term AI adoption.

Lowe’s, for instance, began its partnership with OpenAI by utilizing machine learning tools across internal functions, including pricing and supply chain management. In 2024, the retailer introduced a GPT called “Product Expert” on ChatGPT, which specializes in home improvement questions. Then, in 2025, it launched 2 AI assistants – one for associates and one for shoppers – in collaboration with OpenAI.

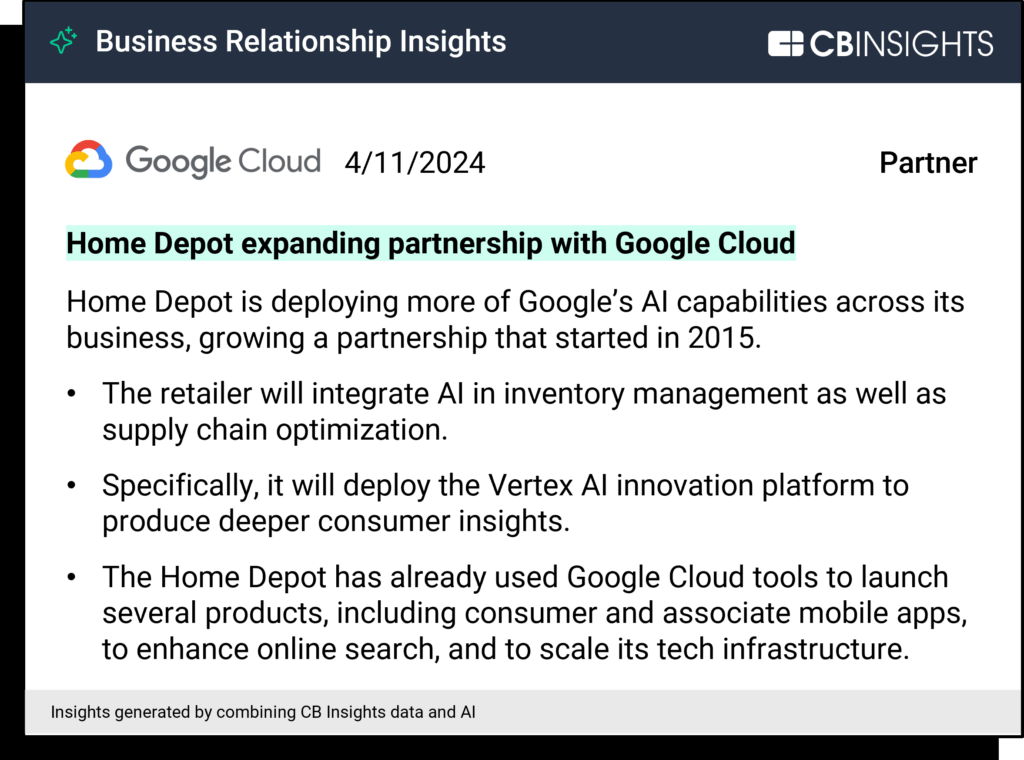

The Home Depot, meanwhile, has similarly relied on its partnership with Google Cloud to power its AI advancements for a decade. The company uses Google AI to improve inventory management and supply chain efficiency and has integrated Google’s AI and machine learning capabilities into its customer search, as well as its employee and consumer apps. The newest generative AI feature on Home Depot’s website, Magic Apron, is an AI agent specializing in home improvement projects; the company used Google Cloud’s vertical agents solution to build it.

Source: CB Insights – Home Depot business relationships

These relationships suggest that external partnerships and infrastructure will be essential for most retailers to effectively integrate AI throughout their operations. Within these relationships, it will be crucial for retailers to consider how their external partners are utilizing their data to train models that their competitors may also leverage, which could erode any competitive advantages gained from the partnership.

While agentic commerce remains further on the horizon, retailers are investing in AI to streamline operations, especially in merchandising.

Big tech and AI leaders are leading the charge for agentic commerce, while traditional retailers are lagging.

Perplexity, OpenAI, and Google have all introduced agents that can autonomously compare prices, read reviews, and complete purchases on behalf of consumers.

While Amazon and Alibaba have both released browser agents with the capability to shop and buy for consumers, neither they nor any other retailers on this list have launched or partnered on agentic shopping or payments solutions. However, as autonomous commerce rapidly evolves, major retailers will have to act fast to stay competitive.

In the meantime, for retail leaders, AI solutions for merchandising are becoming table stakes. More personalized and effective genAI e-commerce search is the most common upgrade, deployed by retailers from Walmart and JD.com at the top of the ranking to Target and CVS at the bottom. GenAI is also powering online content generation across retailers.

Retailers’ merchant teams are also using specialized genAI tools and assistants to quickly translate data and trends to inform product decisions. AI solutions are also fueling demand and inventory forecasting for companies like Amazon, JD.com, and Coupang.

Notably, AI-powered tools are not limited to digital or online use. Several retailers have developed AI solutions to enhance the in-store shopping experience and make it more efficient. 7-Eleven is partnering with Sony Semiconductor Solutions to track customer activity in aisles using vision detection. Home Depot, Target, Walmart, and others have also deployed specialized genAI assistants and agents to provide store associates with quick answers to customer questions.

Looking ahead

While access to capital and AI firepower is helping Amazon, OpenAI, and Google lead the way in AI’s retail deployment, retail “natives” may have some advantages in the long run. Walmart, Coupang, and other major competitors have easy access to transaction data, an understanding of the retail value chain, and a built-in supply chain and fulfillment structure. In addition, many of the retailers on this list also have stores, where roughly 82% of all US retail sales still occur, giving them a continued profit source as well as a broader view of how consumers shop.

That said, agents’ entry into shopping has the power to turn the traditional customer journey on its head. We believe that companies already owning critical distribution and financial services infrastructure, in addition to AI innovation, are best positioned to own the customer relationship — putting big tech leaders like Apple, OpenAI, and Google in the driver’s seat. To stay competitive, retailers and other consumer-facing businesses must quickly build partnerships with big tech and other agent leaders or risk consumers excluding them from their buying decisions.

RELATED RESEARCH FROM CB INSIGHTS

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.

0 Comments