Key Takeaways

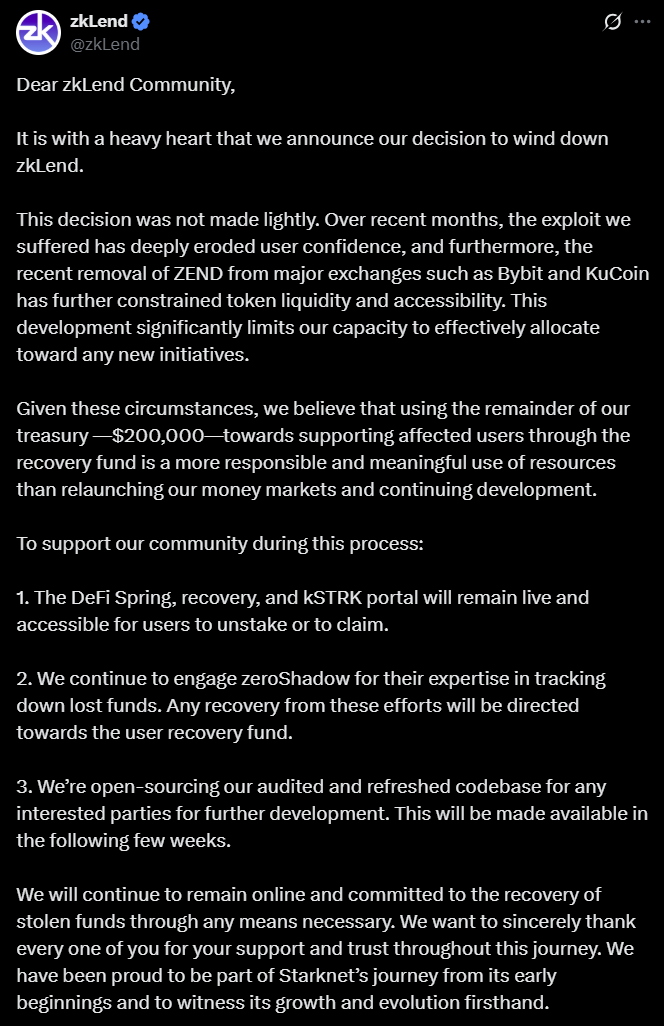

- zkLend is shutting down after a security exploit and the ZEND token’s delisting from Bybit and KuCoin.

- The protocol will use its remaining $200,000 treasury to support affected users and is open-sourcing its codebase.

Share this article

zkLend, a decentralized lending protocol built on Starknet, has announced it will cease operations in the wake of a February 2025 exploit that led to the loss of nearly $10 million and the delisting of its ZEND token from major crypto exchanges.

The protocol will allocate its remaining treasury of $200,000 toward a recovery fund to support affected users rather than relaunching its money markets and continuing development.

The protocol will maintain its DeFi Spring, recovery, and kSTRK portal for users to unstake or claim funds. The team continues to work with zeroShadow to track down lost funds, with any recoveries to be directed to the user recovery fund.

zkLend also plans to open-source its audited and updated codebase in the coming weeks for interested parties to continue development.

“We will continue to remain online and committed to the recovery of stolen funds through any means necessary,” the team stated. “We have been proud to be part of Starknet’s journey from its early beginnings and to witness its growth and evolution firsthand.”

Share this article

0 Comments