- BNB bounced off $639 support as Non-Sybil Users hit 1.7 million and Active Addresses reached 2 million.

- If user and whale momentum persists, Binance Coin could target $674; if not, a retest of $639 is likely.

After hitting a local high of $673, Binance Coin [BNB] retraced following political tensions in the Middle East, reaching a low of $639.

However, over the past day, the altcoin has successfully defended the $640 support level and bounced back.

This isn’t bots—it’s a breakout in real demand

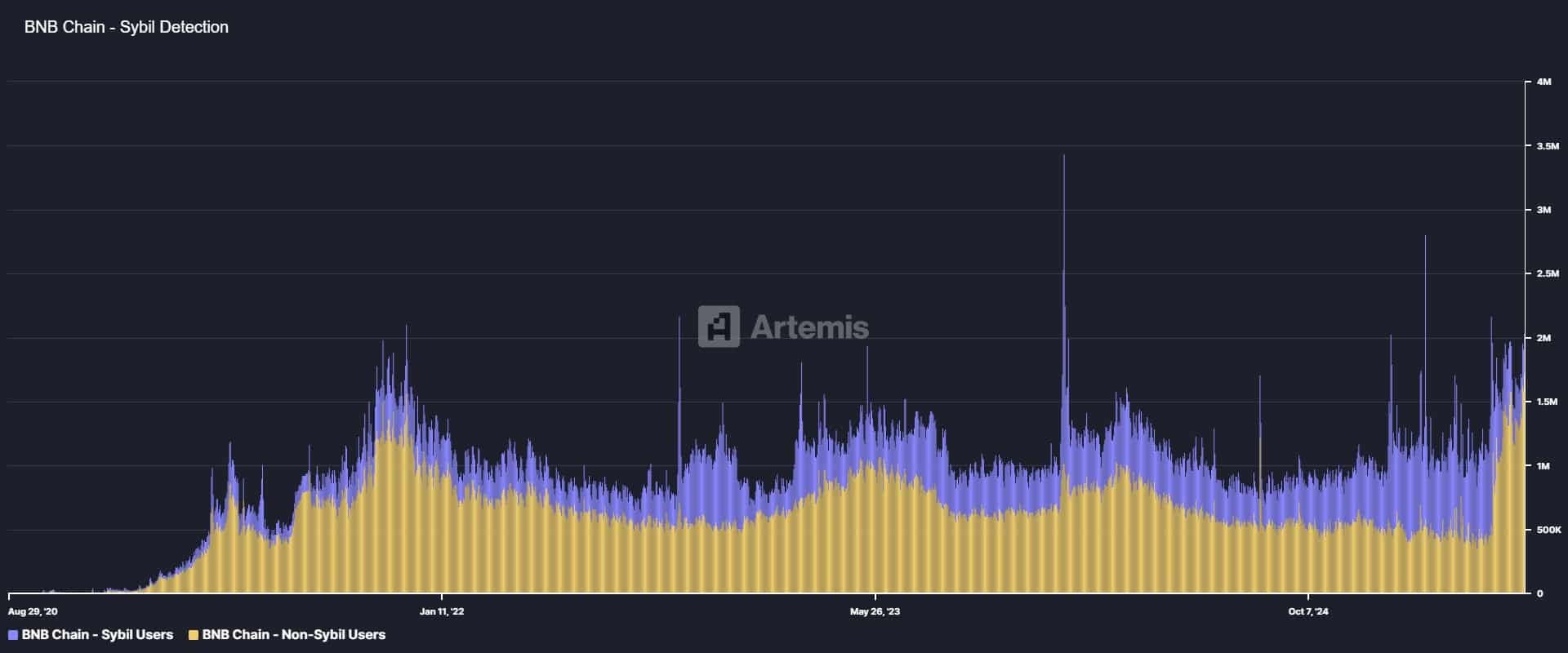

According to AMBCrypto’s analysis, new on-chain data suggests the rebound wasn’t random. BNB’s Non-Sybil Users hit an all-time high of 1.7 million, per Artemis.

These are verified real users, excluding airdrop hunters and bots, making the surge far more meaningful.

Source: Artemis

As such, more real people are actively using BNB chain and not bots or aidrop hunters. Thus, there’s growing interest, demand, and utility for BNB as the network becomes stronger.

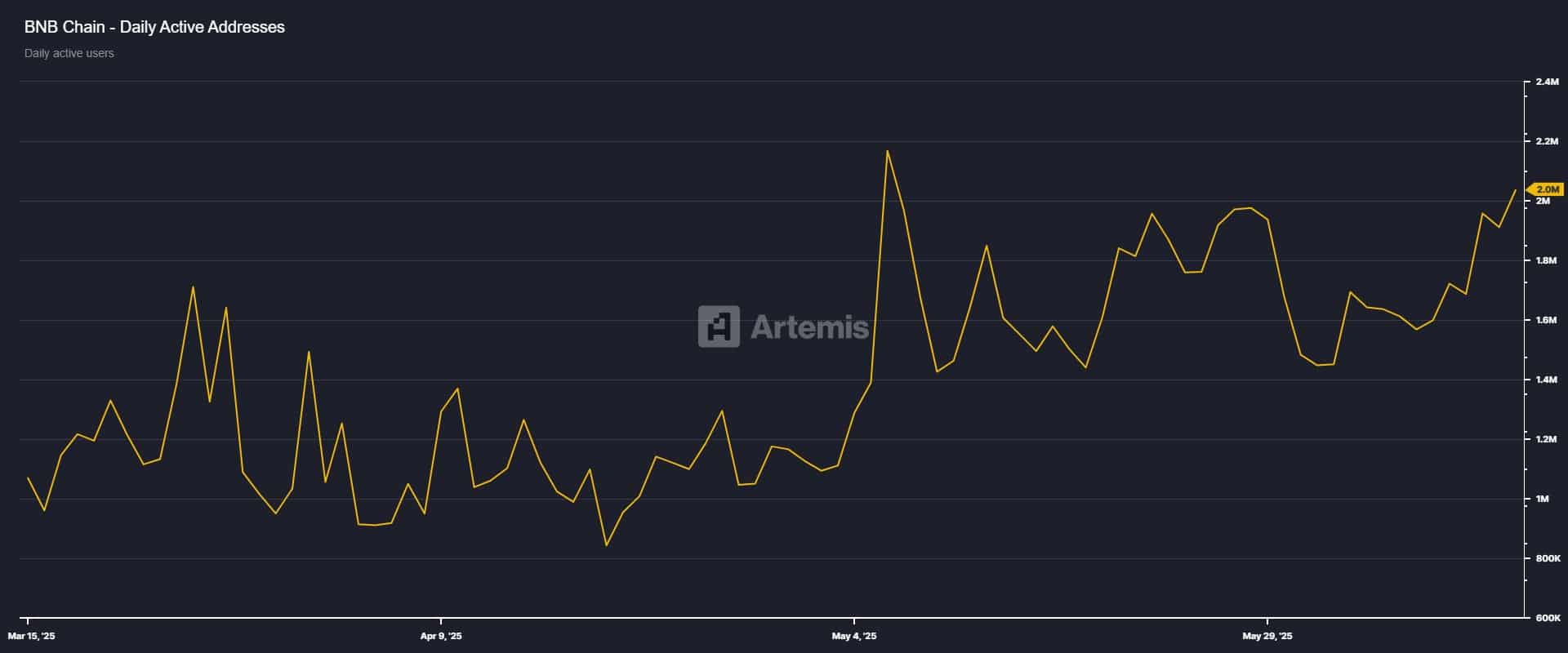

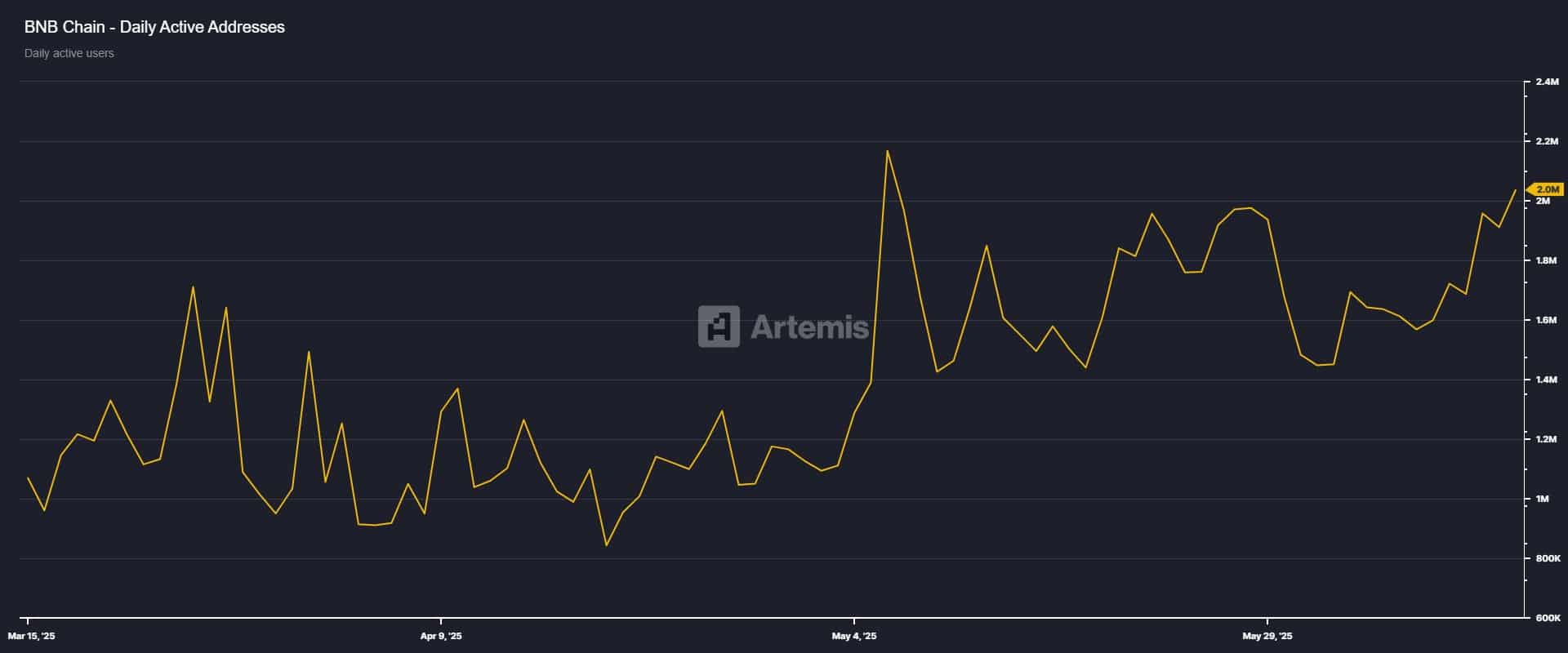

Source: Artemis

Amid this growing number of actual users, BNB Active Addresses have also surged significantly, hitting a monthly high of 2 million. Among these active addresses are new wallets, which have also spiked to hit a month high of 595.7k.

Such a significant surge in active addresses and new entrants reflects growing demand for the chain. Historically, a higher number of users pushes demand higher, which precedes increased prices.

Futures say “bullish”—And the whales agree

Amid a growing user base, bullish sentiments are also expanding across all market participants.

Currently, it seems that users entering the market are mostly bullish and are also large entities.

Source: CryptoQuant

BNB’s Futures Taker CVD (Cumulative Volume Delta) remains buyer-dominant over the past 90 days. That means taker orders in futures are mostly long-biased, confirming market conviction.

What’s more interesting: Futures Average Order Size shows large whale trades have returned. Green dots dominate recent charts, confirming that big players are stepping back in.

These participants are highly bullish as they are entering into the futures to take long positions, as longs account for 73% of the total contracts.

This implies that bullish sentiments are also dominant and investors anticipate prices to rise further.

Source: CryptoQuant

With the adoption rate soaring while investors are bullish, these conditions set BNB in a favorable position for further gains.

When the number of users surged to such levels on the 6th of May, BNB broke out of consolidation and surged to $692.

Therefore, if the conditions witnessed persist, the altcoin will complete the trend reversal and eye $674.

However, if the number of users entering fails to boost BNB higher, the altcoin will retrace and retest the $639 support level.

0 Comments