Some questions that are rattling around in my head along with some quips, answers and guesses.

1. What seems obvious now that will look foolish with the benefit of hindsight in the future? Probably something to do with crypto, AI, tech stocks, government debt or climate change.

2. Why do some beers taste better on draft while others taste better from a bottle or can? Guinness is always better from the tap. Mexican beers like Corona, Pacifico, Modelo, etc. are always better in a bottle (with a lime of course). Light beers are more refreshing in a can.

Why?

I don’t know it just is.

3. What will be the cause of the next financial crisis? It will probably be something no one sees coming but my guess would be deregulation will go too far and we’ll get some sort of financial asset bubble that pops.

4. Why is it that I’m willing to watch 10-12 episodes of a 30-minute length TV show, but a movie that’s 2 hours and 15 minutes always seems ungodly long? We need to bring back the 90-minute movie.

5. What’s a common practice today that future generations will laugh at? It might be driving your own car although I’m sure there will be plenty of holdouts even when it becomes obvious self-driving capabilities are much better than human drivers.

6. What aspect of artificial intelligence are we going to regret as a society? I’m looking forward to having an AI personal assistant, AI tutors for my kids and an AI travel agent.

But I think the movie Her is going to come to life where people have relationships with some form of AI and it’s going to get really weird.

7. What’s something you strongly believe that you hope you’re wrong about? I think it’s basically impossible to fix the healthcare system in the United States. I hope I’m wrong.

8. What’s your worst form of sunk costs not mattering? It’s The Bear, season 4 for me. That show was one of the best things on TV and it fell of a cliff. I still had to finish this season because I made the prior investment.

They neutered one of the best TV characters this decade (Cousin Richie).

Will I still watch season 5? Yes.

9. Will AI lead us all to work more, not less? Computers, word processors, Excel, the internet, email, smartphones, Zoom calls and other forms of technology have made us all far more efficient. And yet…people work more than ever.

Everyone always complains about being soooo busy.

AI will make us more efficient but probably just work even more than most people do now.

10. How will the baby boomer transfer of power in the housing market play out? We’ve never seen anything like the dominance of baby boomers in the housing market. This is from Business Insider:

Baby boomers dominate America’s housing market. They own roughly $19.7 trillion worth of US real estate, or 41% of the country’s total value, despite accounting for only a fifth of the population. Millennials, by comparison, make up a slightly larger share of the population but own just $9.8 trillion of real estate, or 20%.

But Father Time will even things out eventually:

Between 2025 and 2035, boomers’ numbers are projected to decline by 23%, or about 15.6 million people, according to an analysis of Census data by the Harvard Joint Center for Housing Studies. Between 2035 and 2045, their numbers are expected to drop by another 47%, or 23.4 million people.

Will the next generation sit on these houses that get passed down to them? Or will they sell them immediately?

Either way, this trend will take some time to play out.

11. What’s something you would be willing to change your mind about if the facts change? I’ve always thought college sports were more fun to watch than pro sports. College football is the best. I love March Madness.

I wonder if NIL money, college free agents and conference realignment will change my views here.

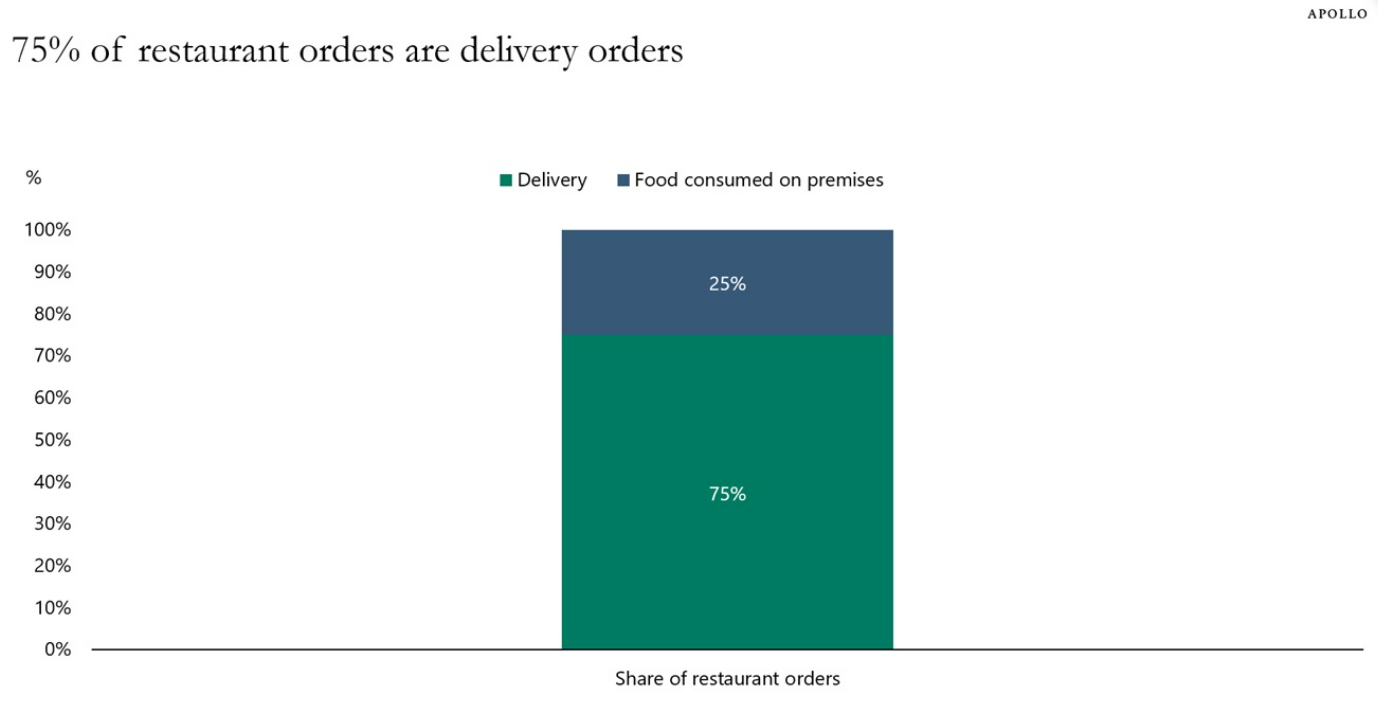

12. Is Doordash going to be the new latte factor for personal finance gurus. Torsten Slok has this chart showing how most people prefer delivery orders to eating in a restaurant:

Doordash feels like one of life’s luxuries that’s becoming a necessity for a lot of people. I should try to make it the new latte factor.

13. What’s an incredible innovation we take for granted because we’re used to it? I know some people get nostalgic for a Friday night perusing Blockbuster Video but streaming is an unbelievable leap forward.

I can think of an old movie I want to watch, pull it up on Prime Video or Apple, own or rent it, and watch it immediately.

This would seem like magic to my 1990s self who always forgot to rewind the VCR before bringing back a rental to Family Video.

14. Why is it always so difficult to predict an asset bubble? People have been calling tech a bubble since 2015. Everyone who called the dot-com bubble and the GFC have been wrong for years about this cycle.

Human nature is a tricky beast to pin down.

15. How has career risk shaped your actions? As someone who works in the wealth management industry, I’ve been called a shill for the stock market in the past. Obviously, it’s a good thing for our business if the markets move higher.

I’m sure there’s a career risk aspect to my love for the stock market but I also have skin in the game. The bulk of my personal assets are invested in equities.

And if the stock market fails to go up in the future we all likely have bigger problems to worry about.

16. Is an AI bubble inevitable? We’ve never really seen an innovation that transforms society that didn’t lead to a bubble. I’ll bet there was even a wheel bubble for the cavemen back in the day.

I would be more surprised if this doesn’t turn into something crazy.

17. Will we ever actually see a government debt crisis in America? My head says maybe but my heart says no, we’ll just keep kicking the can down the road.

18. When will second-level thinking start working again? Howard Marks came up with the idea of first and second-level thinking that goes like this:

First-level thinking: It’s a great company, you should buy it.

Second-level thinking: It’s a great company but everyone already knows that and the stock is overpriced. You should sell it.

First-level thinking has won out over second-level thinking for the past 15 years or so, and it’s not even close.

Just buy all of the great companies you know — Apple, Facebook, Amazon, Microsoft, Netflix, Google, Tesla — and watch them go up.

Investing is usually not that easy.

I have no idea when that will change but it won’t always be like this.

19. Why do personal finance experts focus on $5 coffees instead of $50,000 automobiles? It’s the big purchases like housing and transportation that matter. Enjoy your Starbucks.

20. What will finally brings this economic cycle to an end? It feels like there is so much money sloshing around that the music will just keep playing but I know cycles never last forever.

I’ll have some thoughts on this topic later in the week.

Further Reading:

Mega Cap World Domination

0 Comments